EU intra-community distance selling¶

Distance sales within the European Union include cross-border sales of goods and services to a private consumer (B2C) in another EU Member State when the seller doesn’t meet face-to-face with the customer. Organizations must ensure that the VAT on distance sales is paid to the Member State in which the goods or services are delivered.

注解

即使您的组织位于欧盟以外,情况仍然如此。

虽然该法规主要适用于:d oc:’电子商务<。/../../../websites/ecommerce>’销售给私人欧盟消费者,它也适用于邮购销售和电话销售。

The Union One-Stop Shop (OSS) is an online portal where businesses can register for the OSS and declare their intra-community distance sales. Each EU member state integrates an online OSS portal.

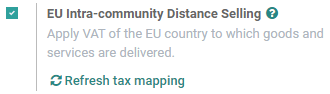

The EU intra-community Distance Selling feature helps your organization comply with this regulation by creating and configuring new fiscal positions and taxes based on your company’s country.

配置¶

转到:menuselection:’会计/发票 –>设置 –>税费’,然后启用 欧盟共同体内远程销售**(如果您在 2021 年 7 月 1 日之前创建了数据库,则启用 **欧盟数字商品增值税)和 保存。

重要

Please upgrade the module l10n_eu_service if you already installed it

before July 1, 2021, or if you activated the feature EU Digital Goods VAT in the

Accounting settings. Then, make sure to refresh the tax mapping.

财政状况和税收¶

Once enabled, the feature automatically creates all the necessary taxes and fiscal positions needed for each EU member state, based on your company’s country.

We highly recommend checking that the proposed mapping is suitable for the products and services you sell before using it.

Refresh tax mapping¶

Whenever you add or modify taxes, you can update automatically your fiscal positions.

To do so, go to and click on the Refresh tax mapping button.