哥伦比亚¶

网络研讨会¶

您可以在下面找到带有本地化的一般说明以及如何配置它的视频。

“完整演示<https://youtu.be/Y83p3YK1lFU>的视频网络研讨会”_。

介绍¶

哥伦比亚的电子发票可从 otoo 12 获得, 需要下一个模块:

l10n_co: All the basic data to manage the accounting module, contains the default setup for: chart of accounts, taxes, retentions, identification document types

l10n_co_edi:此模块包括与Carvajal集成所需的所有额外字段,并根据DIAN法律要求生成电子发票。

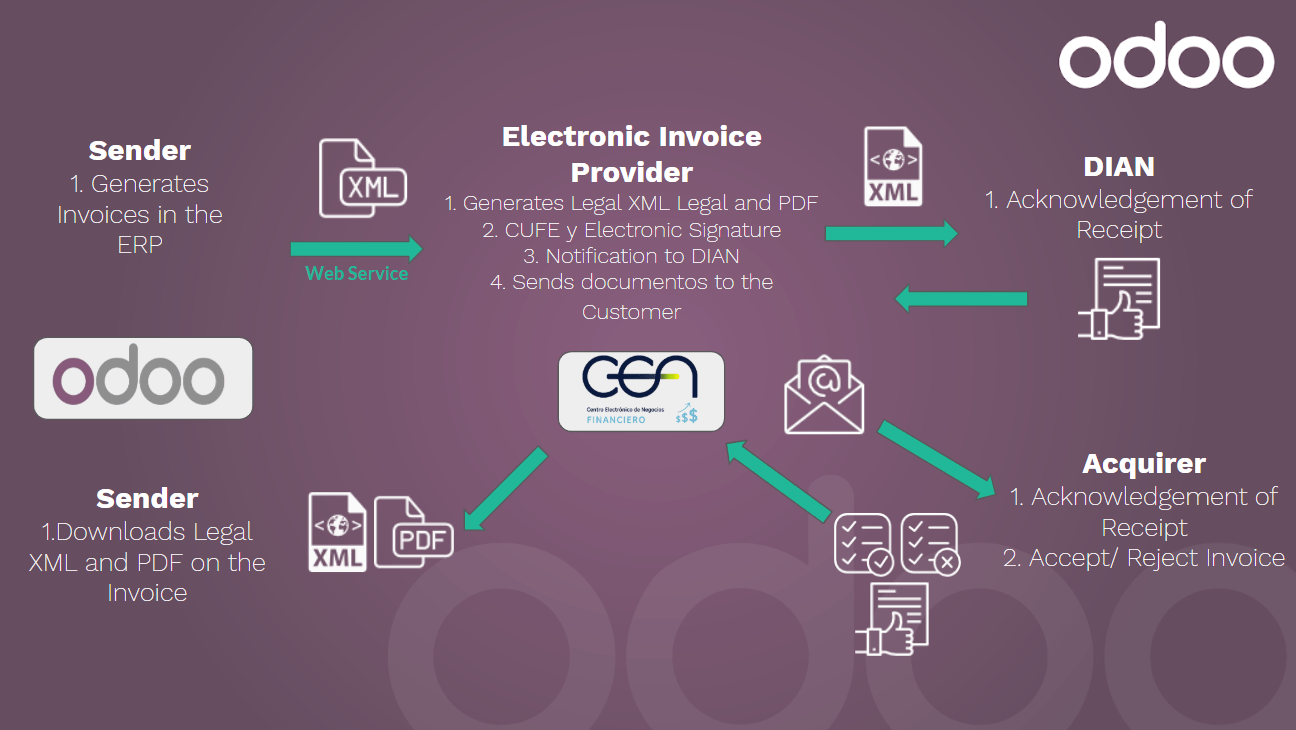

工作流¶

配置¶

Install the Colombian localization modules¶

要 :ref:install <general/install> 模块,请转到 :menuselection:Apps,删除 Apps 过滤器并搜索 “Colombia”。然后单击前两个模块的“安装”。

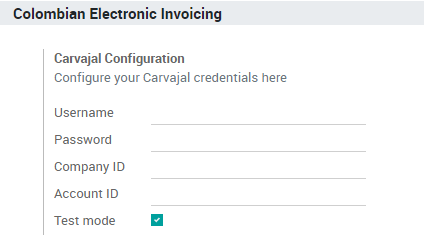

配置 Carvajal Web 服务的凭据¶

一旦安装了模块,为了能够与Carvajal Web Service连接,有必要配置用户和凭据,此信息将由Carvajal提供。

进入:menuselection:`菜单选择:`会计->配置->设置`并查找*哥伦比亚电子发票*章节.

使用测试模式,可以与Carvajal测试环境连接。这允许用户测试完整的工作流程以及与CEN金融门户的集成,可在此处访问:

- CTS (Carvajal T&S)

- CSC (Carvajal Servicios de Comunicación)

CSC 是新数据库的默认值。

一旦Odoo和Carvajal完全配置并准备好投入生产,就可以禁用测试环境。

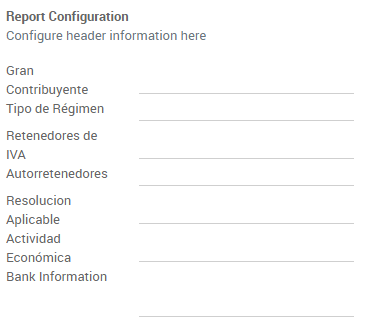

Configure your report data¶

As part of the configurable information that is sent in the XML, you can define the data for the fiscal section and the bank information in the PDF.

进入:menuselection:`菜单选择:`会计->配置->设置`并查找*哥伦比亚电子发票*章节.

Configure data required in the XML¶

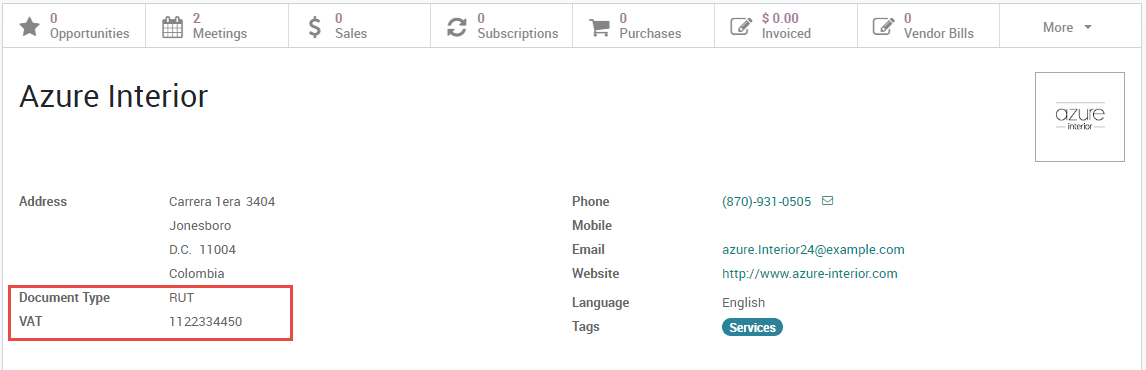

业务伙伴¶

ID¶

As part of the Colombian Localization, the document types defined by the DIAN are now available on the Partner form. Colombian partners have to have their identification number and document type set:

小技巧

When the document type is RUT the identification number needs to be configured in Odoo including the verification digit, Odoo will split this number when the data to the third party vendor is sent.

Fiscal structure (RUT)¶

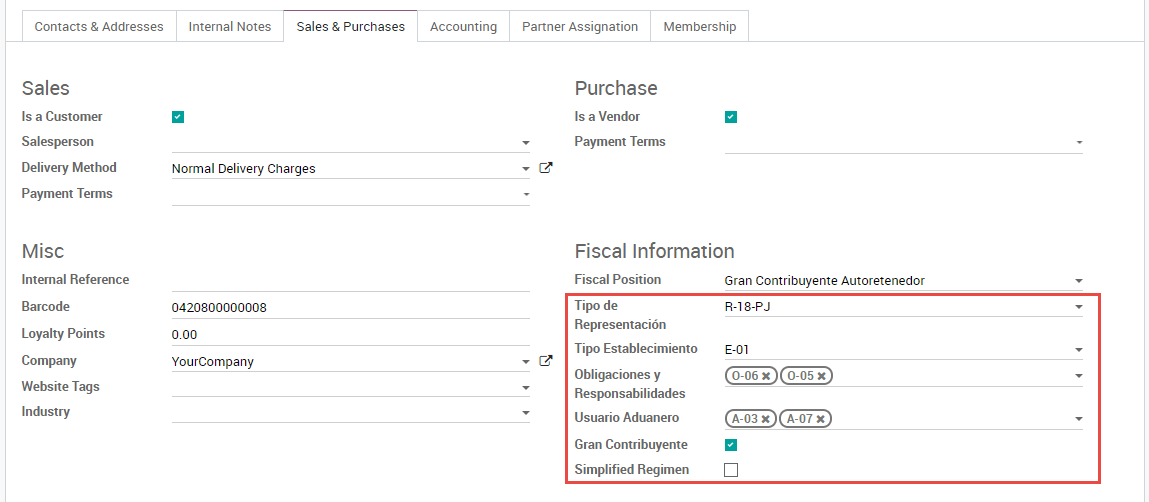

The partner’s responsibility codes (section 53 in the RUT document) are included as part of the electronic invoice module given that is part of the information required by the DIAN .

These fields can be found in

Additionally two booleans fields were added in order to specify the fiscal regimen of the partner.

税¶

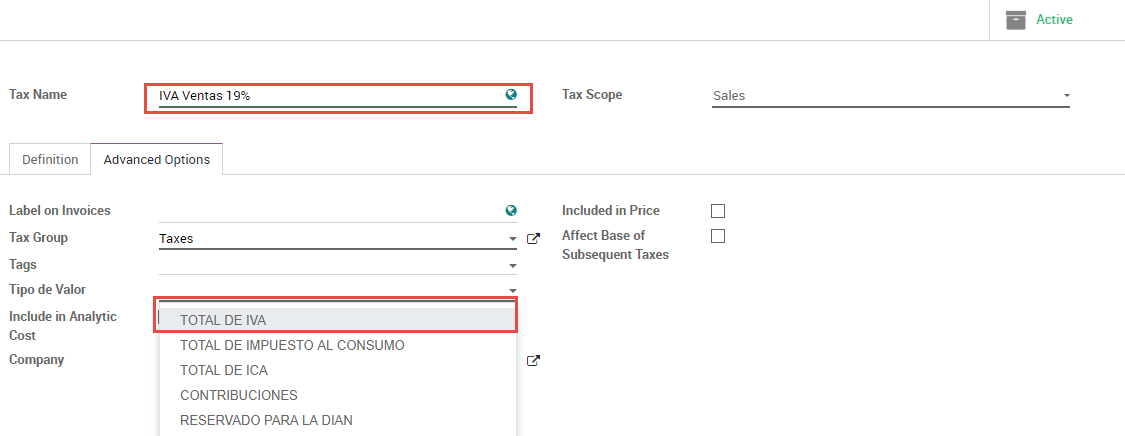

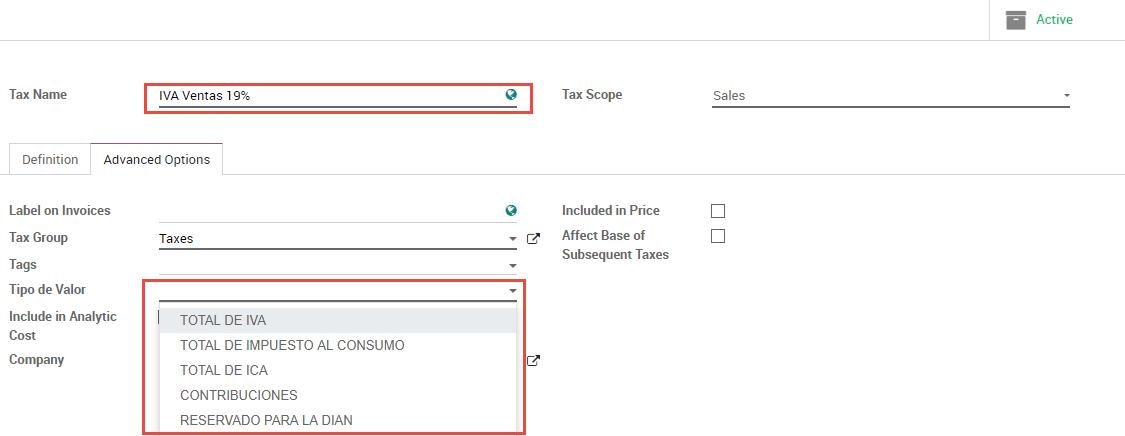

If your sales transactions include products with taxes, it’s important to consider that an extra field Value Type needs to be configured per tax. This option is located in the Advanced Options tab.

Retention tax types (ICA, IVA, Fuente) are also included in the options to configure your taxes. This configuration is used in order to correctly display taxes in the invoice PDF.

日记账¶

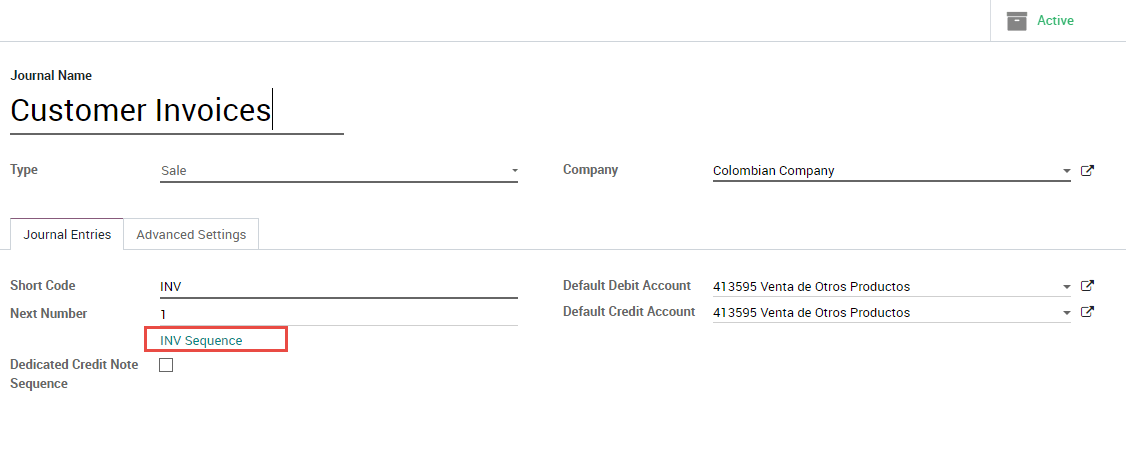

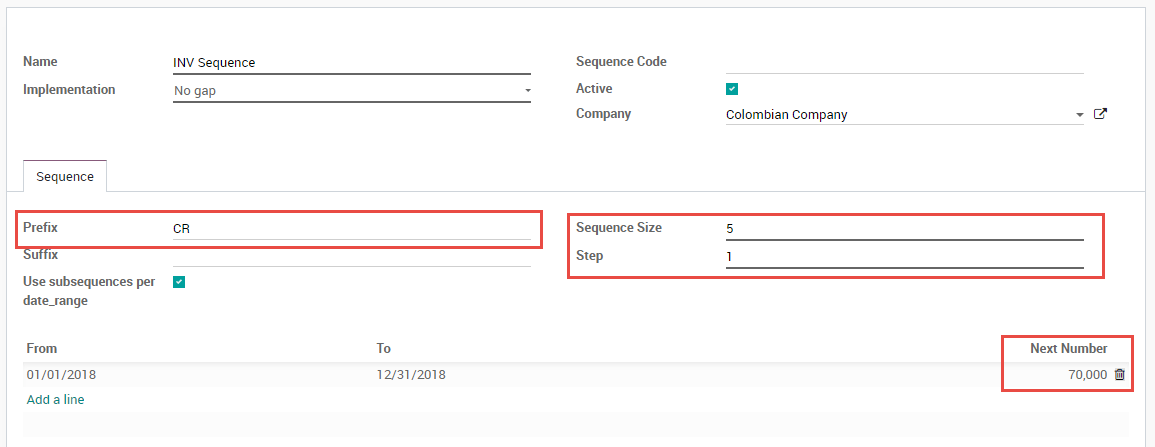

一旦 DIAN 为电子发票解析分配了官方序列和前缀,就需要在 Odoo 中更新与您的发票文档相关的销售日记帐。 可以使用 :ref:developer mode <developer-mode>: :menuselection:`Accounting –> Settings –> Configuration Setting –> Journals`</developer-mode> 访问该序列。

Once that the sequence is opened, the Prefix and Next Number fields should be configured and synchronized with the CEN Financiero.

用户¶

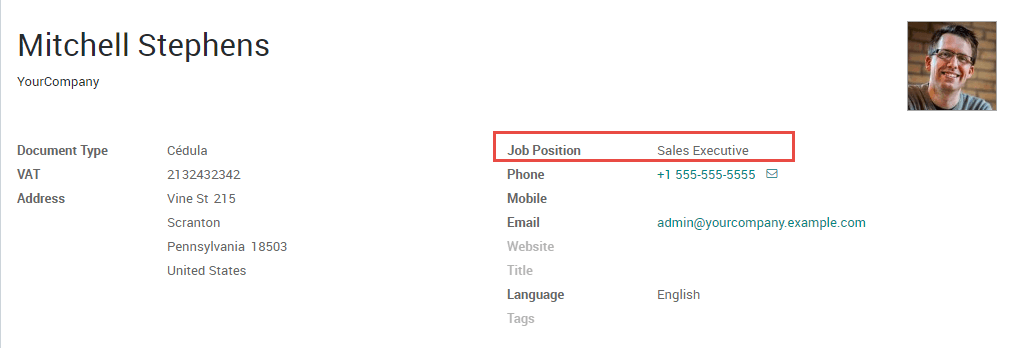

The default template that is used by Odoo on the invoice PDF includes the job position of the salesperson, so these fields should be configured:

用法和测试¶

结算单¶

When all your master data and credentials has been configured, it’s possible to start testing the electronic invoice workflow.

发票创建¶

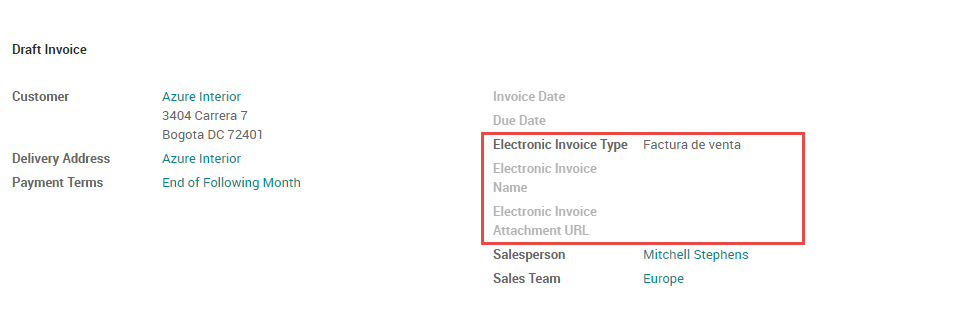

The functional workflow that takes place before an invoice validation doesn’t change. The main changes that are introduced with the electronic invoice are the next fields:

There are three types of documents:

Factura Electronica: This is the regular type of document and its applicable for Invoices, Credit Notes and Debit Notes.

Factura de Importación: This should be selected for importation transactions.

Factura de contingencia: This is an exceptional type that is used as a manual backup in case that the company is not able to use the ERP and it’s necessary to generate the invoice manually, when this invoice is added to the ERP, this invoice type should be selected.

Invoice validation¶

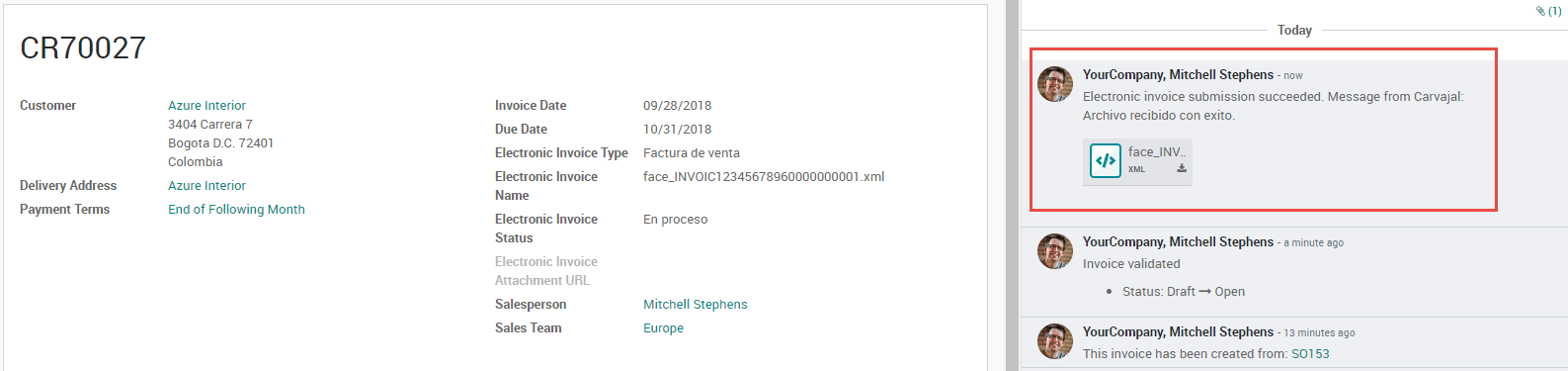

After the invoice is validated an XML file is created and sent automatically to Carvajal, this file is displayed in the chatter.

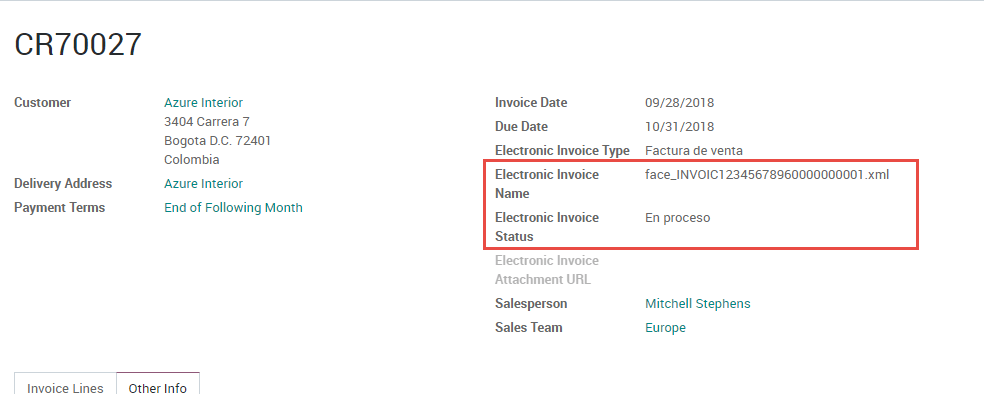

An extra field is now displayed in “Other Info” tab with the name of the XML file. Additionally there is a second extra field that is displayed with the Electronic Invoice status, with the initial value “In progress”:

Reception of legal XML and PDF¶

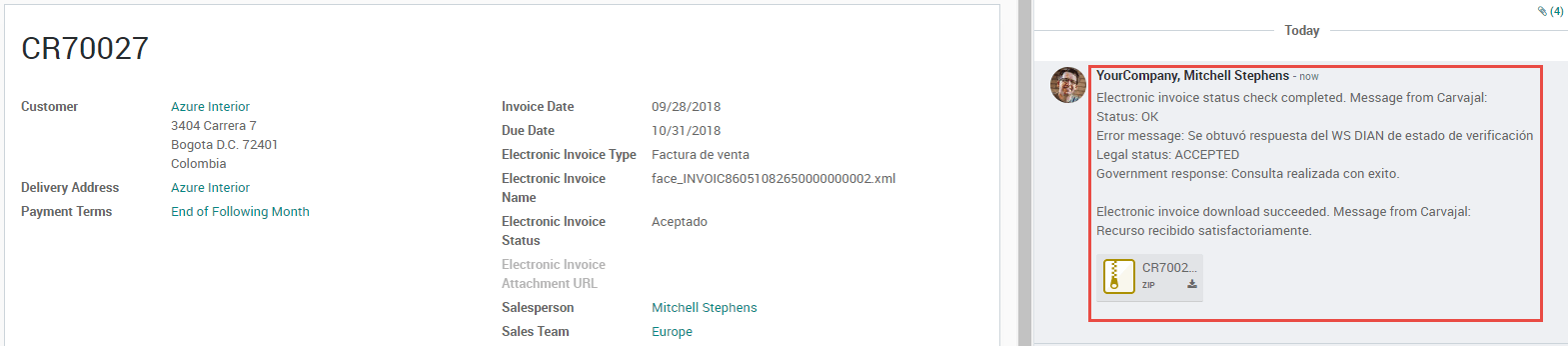

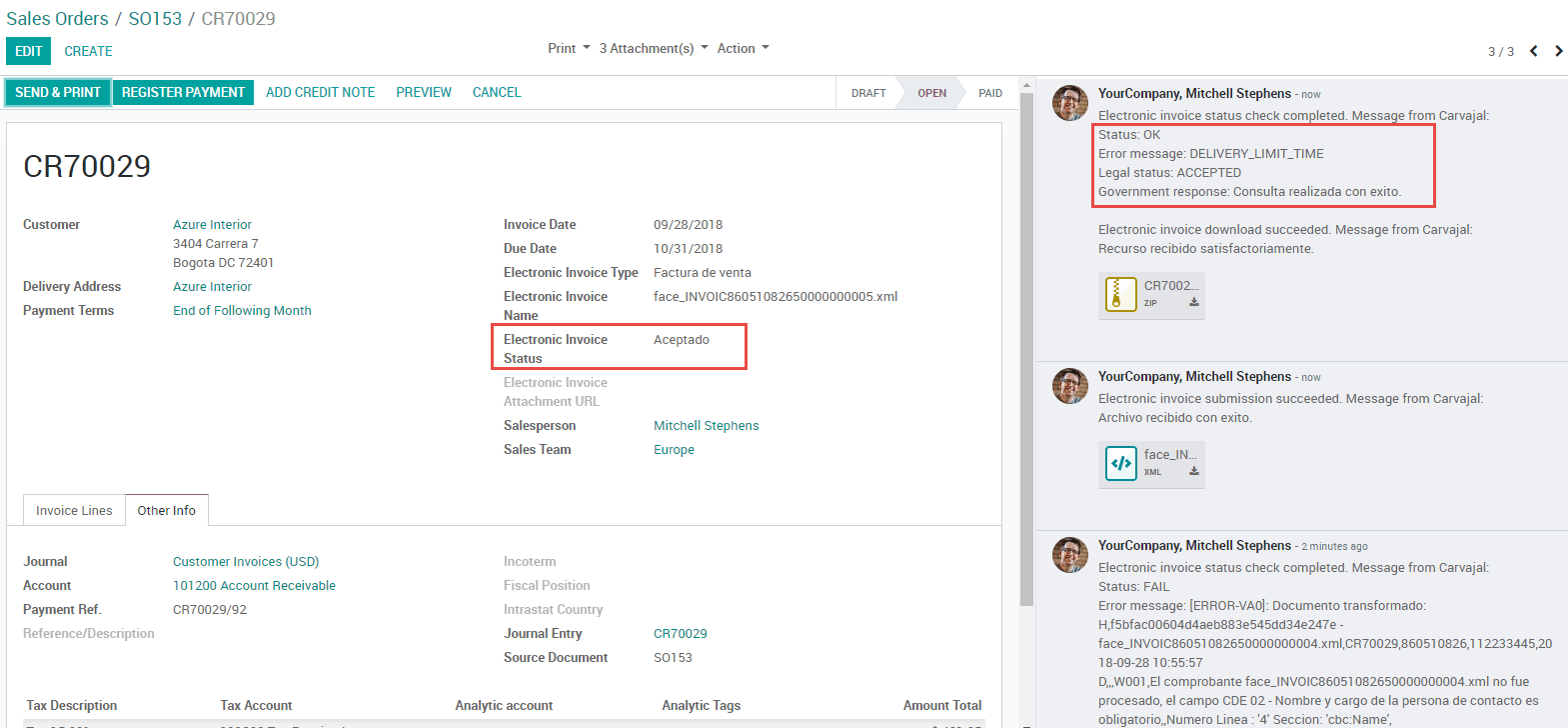

The electronic invoice vendor receives the XML file and proceeds to validate the structure and the information in it, if everything is correct the invoice status changes to “Validated” after using the “Check Carvajal Status” button in the Action dropdown. They then proceed to generate a Legal XML which includes a digital signature and a unique code (CUFE), a PDF invoice that includes a QR code and the CUFE is also generated.

After this:

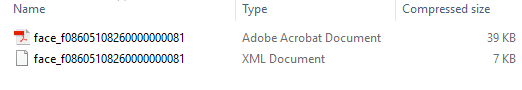

A ZIP containing the legal XML and the PDF is downloaded and displayed in the invoice chatter:

The Electronic Invoice status changes to “Accepted”

Common errors¶

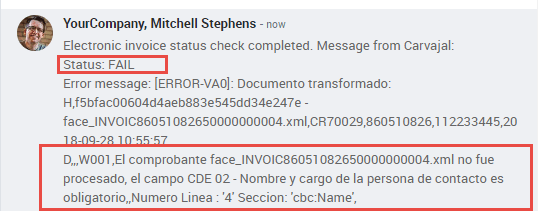

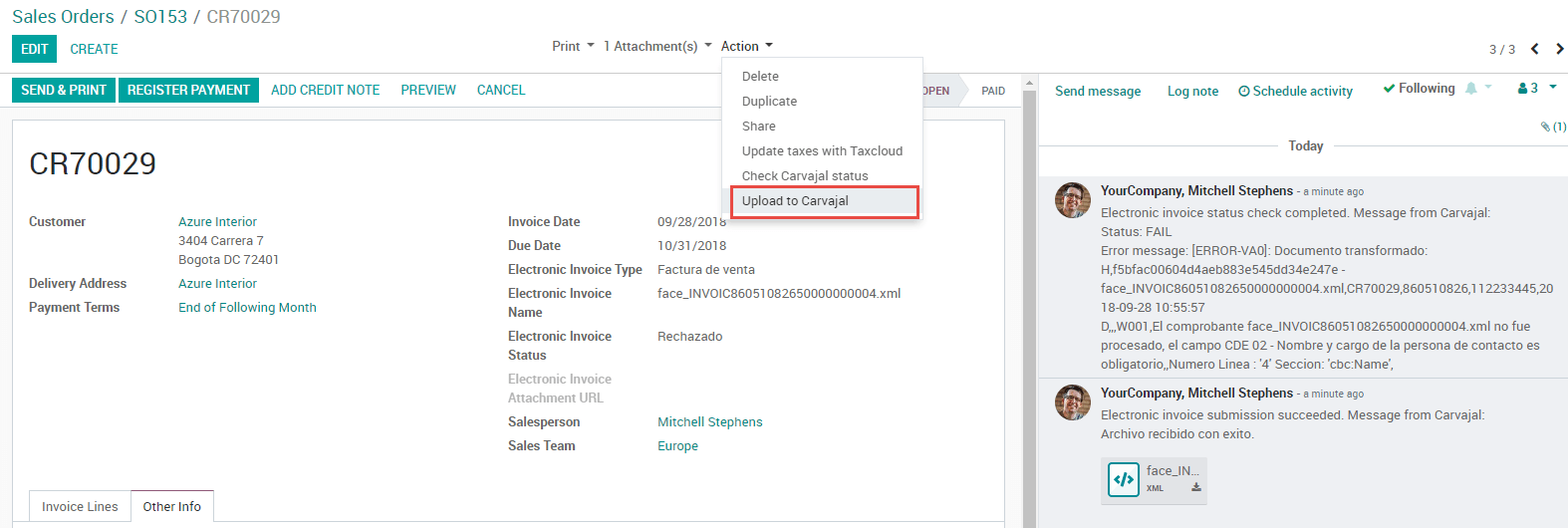

During the XML validation the most common errors are usually related to missing master data. In such cases, error messages are shown in the chatter after updating the electronic invoice status.

After the master data is corrected, it’s possible to reprocess the XML with the new data and send the updated version, using the following button:

Additional use cases¶

The process for credit and debit notes is exactly the same as the invoice, the functional workflow remains the same as well.